Global Insight. Ethical Stewardship. Client-First Execution.

MYJ Capital delivers more than financial solutions. We provide high-net-worth investors with strategic clarity and purpose-aligned portfolio management.

Our model is grounded in macroeconomic intelligence, Shariah-compliant practices, and long-term resilience. Whether you're looking to diversify globally, preserve capital, or align your wealth with purpose, we offer the structure and insight to guide your journey.

Our Approach

Macro-Informed Allocation

We track central bank policy, currency dynamics, and geopolitical shifts to ensure timely, well-informed investment positioning.

Client-Owned, MYJ-Manage

Your wealth remains in your name. We provide active management on regulated platforms like StoneX, giving you institutional-grade access with full transparency.

Diversified Exposure

Our clients access a wide array of permissible asset classes—from global currencies to Shariah-compliant real estate strategies—supported by robust research and risk oversight.

Start With Strategy

We begin by understanding your goals, timelines, and values. Then we build a customized strategy using our three core product tracks:

Dynamic Performance: Active, macro-aligned trading opportunities.

Conservative Performance: Low-volatility, diversified portfolios.

Real Estate Access: Tangible value through ethically screened property channels.

Investment Process

Risk Management

Our portfolio maintains a strict risk management framework to control exposure and protect capital. Risk management is an integral component of our investment philosophy and process. We work to manage risk in three areas.

Execution Strategy

Our risk management approach relies on a systematic combination of technical indicators to identify trends, set risk levels, and refine trade execution.

Composition

Our portfolio is guided by price action, not a long/short strategy. We prioritize liquidity, holding daily positions and longer-term carry trades when rates are favorable, aiming to minimize drawdowns.

Why Currency Trading?

We believe in sustainable and ethical investing. Unlike traditional stock investments that often fund corporations engaged in harmful practices, our focus on foreign exchange trading provides a unique way to invest without contributing to environmental degradation or unethical labor practices.

Why Real Estate?

MYJ invests in and develops U.S. real estate, providing uncorrelated returns and passive income—without ownership hassles.

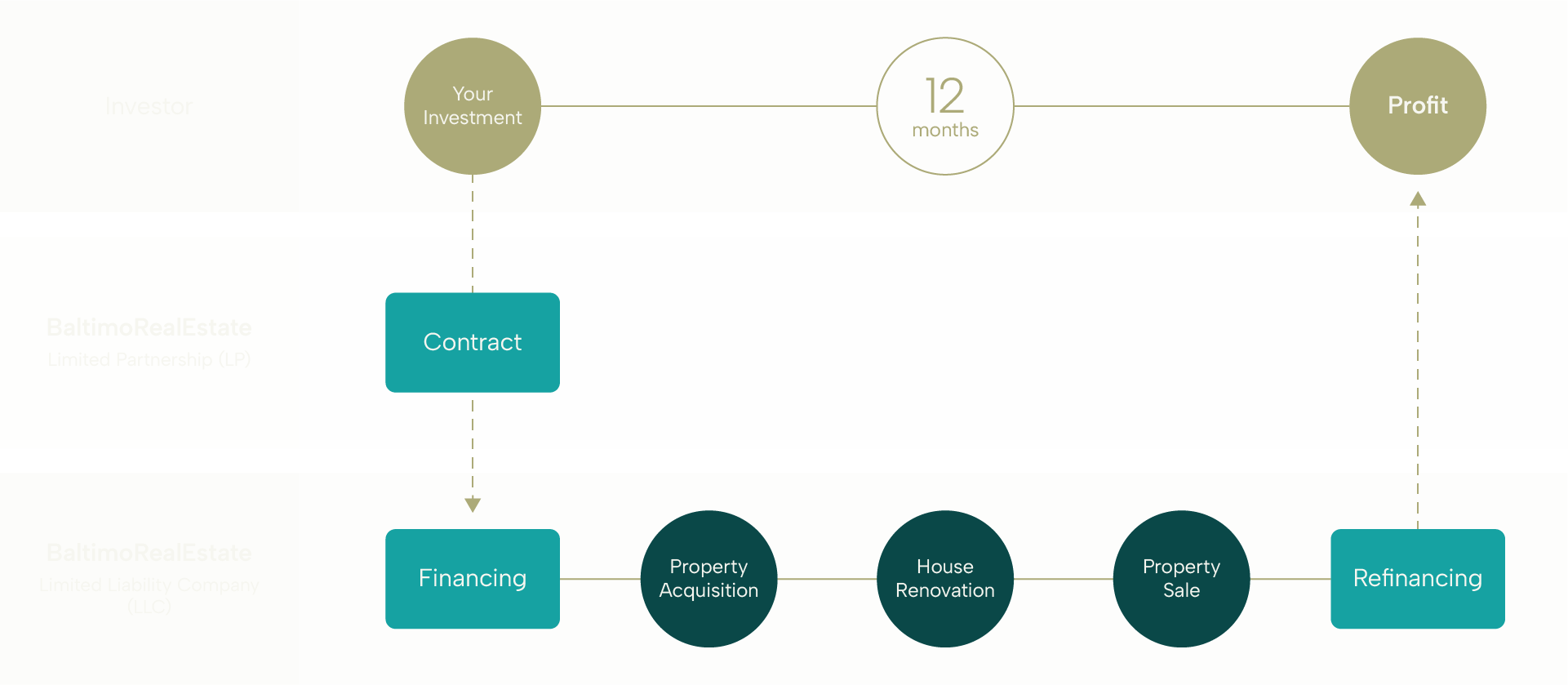

Operated under BaltimoRealEstate, this investment offers a seamless turnkey solution, identifying high-potential real estate opportunities to maximize returns. With a predictable profit distributed monthly after 12 months, we ensure investor security by transferring funds from the LP to the LLC, minimizing liability risks and safeguarding liquidity.