Energy Shift: Dependable Power Meets Investment Opportunity

Global Energy Dynamics are Evolving Rapidly

Climate goals are no longer the sole focus. Today, energy reliability, scalability, and cost efficiency drive investment decisions. The sharp reduction in Europe’s reliance on Russian natural gas has triggered a restructuring of global energy supply chains. The United States has become Europe’s leading LNG supplier, while domestic energy demand continues to grow—fueled by the resurgence of manufacturing and the energy needs of AI data centers.

This global realignment presents a dual opportunity: enhancing energy resilience while tapping into long-term investment growth.

Three companies at the forefront of the energy transition

GTT (France): LNG Infrastructure Leader

As of March 2025, GTT maintains an order book of 325 units, including:

292 LNG carriers (Liquefied Natural Gas carriers – ships transporting LNG at cryogenic temperatures)

21 VLECs (Very Large Ethane Carriers – ships for transporting ethane)

3 FSRUs (Floating Storage and Regasification Units – vessels that store LNG and convert it back to gas)

3 FLNGs (Floating Liquefied Natural Gas units – offshore facilities that produce, liquefy, and store LNG)

5 onshore storage tanks (gtt.fr, globalnewswire.com).

Nextracker (United States): Solar Tracking Technology

In 2024, Nextracker shipped 28.5 gigawatts of solar trackers, securing 26 percent global market share with 39 percent year-over-year growth (pv-magazine-usa.com).

Solar trackers now account for over 55 percent of global solar deployments outside of China, driven by utility-scale infrastructure demand (mordorintelligence.com).

Southern Copper (Peru and Mexico): Supplying the Electrification Era

In 2024, Southern Copper reported 11.43 billion dollars in revenue, a 15 percent increase from the previous year (monexa.ai).

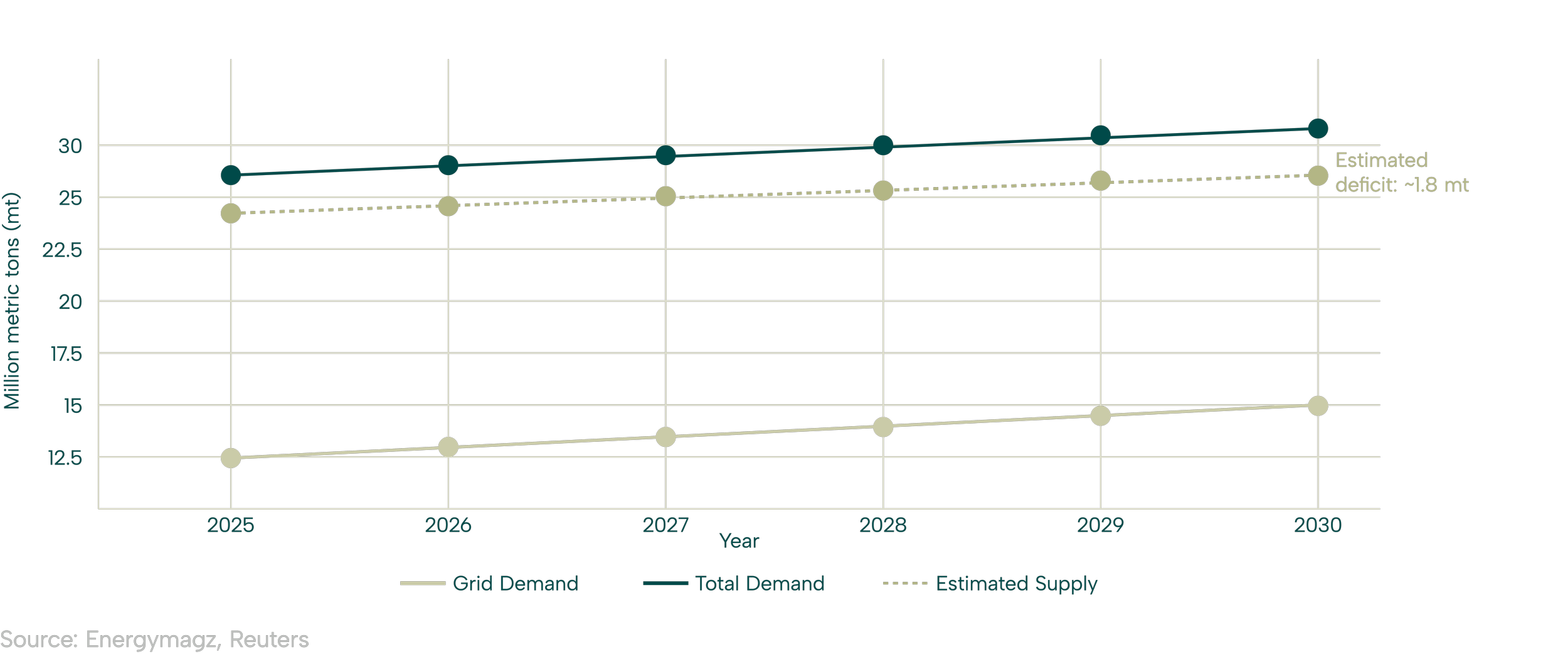

Copper demand is expected to rise from 12.52 million metric tons in 2025 to 14.87 million metric tons by 2030, driven primarily by power grid expansion (reuters.com).

MYJ Capital Insight

Energy security has become a top strategic priority for global economies. Investments in LNG infrastructure, solar tracking systems, and essential metals such as copper are no longer niche. These are now central components of the global energy transition.

At MYJ Capital, we focus on companies that are not only aligned with sustainability but are also operationally scalable, cost-efficient, and positioned to thrive through global energy realignment. We identify resilient, infrastructure-aligned investments that drive long-term performance.

Discover how MYJ Capital positions portfolios at the intersection of energy resilience and growth.

Visit myjcapital.com/insights to explore our latest thinking.