Global Clean Energy Investment Hits Record $3.3 Trillion: Strategic Positioning for Long-Term Portfolios

Global capital flows are undergoing a historic shift. According to the International Energy Agency (IEA), energy investment is projected to reach $3.3 trillion in 2025, with more than two-thirds directed toward clean technologies. For investors, this represents a strategic inflection point: long-term capital is accelerating into renewables, infrastructure, and next-generation energy systems.

The implications are clear. Clean energy is no longer an alternative—it is becoming the dominant allocation theme in global capital markets. Understanding where the flows are heading is essential for positioning portfolios that can withstand volatility while capturing durable upside.

Global Clean Capital Momentum

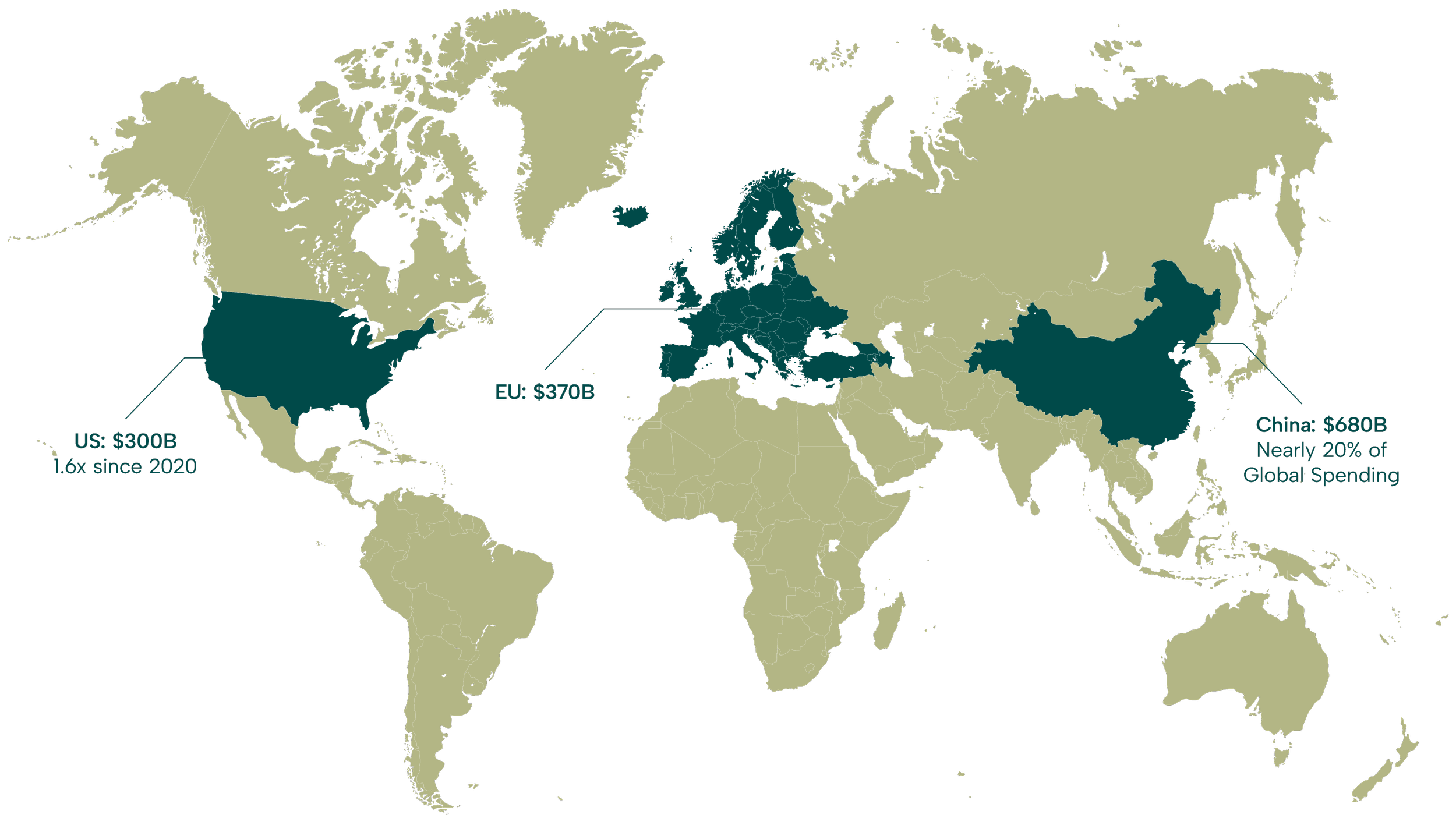

Top Clean Energy Investors (2024-2025)

In 2025, clean technology investment is expected to total $2.2 trillion, outpacing fossil fuels at $1.1 trillion (Renewable Energy Institute). This marks a decisive acceleration: in 2024, for the first time in history, investment in renewables nearly doubled oil and gas spending.

The solar sector leads the charge, with projected investment of $450 billion in 2025 (Mercom India). This makes solar the single largest energy investment category worldwide, underscoring its role as the anchor of the global energy transition.

Regional dynamics add nuance. Advanced economies and China continue to dominate investment volumes, while regions like Africa—despite vast renewable potential—receive only 2% of global clean energy capital (The Guardian). For investors, this imbalance presents both a risk and a frontier opportunity.

Emerging Energy Themes & Risks

1. Hydrogen’s Rise

More than $110 billion has been committed to clean hydrogen projects globally, spanning both green and blue hydrogen (Financial Times). Hydrogen is poised to become a critical enabler for hard-to-abate sectors such as steel, shipping, and heavy transport.

2. Africa’s Green Growth Gap

Africa illustrates the paradox of the energy transition. The continent holds some of the world’s best solar and wind resources, yet remains structurally underfunded—receiving only $15 billion for climate adaptation in 2023 against an identified $70 billion annual need (The Guardian). Capital deployment here could unlock both impact and returns, but geopolitical and governance challenges remain key variables.

3. Volatility in Capital Allocation

Clean energy’s rapid growth does not eliminate risks. Concentration in a few technologies, policy reversals, or delays in infrastructure readiness could introduce volatility. For long-term investors, disciplined selection and diversification are essential.

Strategic Positioning for Investors

For high-net-worth and institutional investors, the energy transition is a structural megatrend. Strategic allocation to clean energy can provide:

Resilient growth exposure: capturing secular expansion in renewables, electrification, and grid modernization.

Portfolio diversification: balancing traditional sectors with future-facing infrastructure.

Private and public opportunities: from listed clean energy ETFs and equities to private placements in hydrogen, solar infrastructure, or climate adaptation projects.

The key is to identify durable themes where capital inflows align with policy, innovation, and structural demand.

MYJ Capital Insight

Global energy investment is tilting decisively toward clean technologies, signaling both opportunity and responsibility for investors. Strategic positioning today is about aligning portfolios with structural shifts that will define returns over the next decade.

At MYJ Capital, we help investors navigate megatrends with clarity and discipline.

Discover how to align your portfolio with the future of energy—request our insights deck at